The vehicle you dreamed of, without waiting or breaking the bank

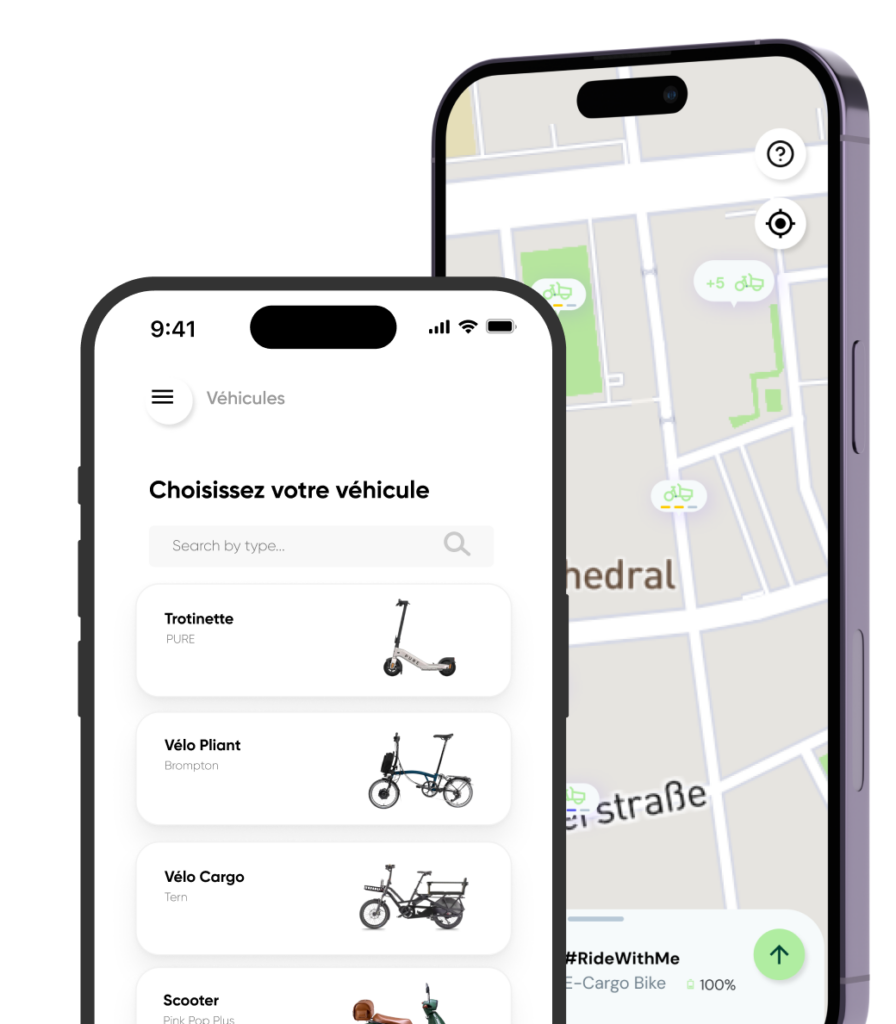

Choose your vehicle...

We’ll take care of the rest

All-inclusive service

Insurance, maintenance, repair

Wide selection of vehicles

Wide selection of vehicles

Flexible

With or without commitment

Connected

Track your subscription on Avo'Mobility

You’re never alone, always supported by our experts

Tangible benefits,

from the very first pedal stroke

- Save up to 30% on your vehicle 💰

- All-inclusive: you don’t have to worry about a thing, except pedaling 📲

- For the planet: Less CO₂, fewer traffic jams, more fresh air for everyone 💚

- For your health: less stress, more energy 🧘

Join the + 2000 subscribers who trust us

5 months ago

A truly great experience! The rental process is simple and makes life easier. I recommend it for daily use or occasional needs 😍

It’s a big yes for this fully approved concept!

6 months ago

4 months ago

5 months ago

FAQ

More questions ?

How does billing work?

The company is charged the full rental fee for the bikes. An employee contribution, directly deducted from their gross salary, offsets the cost for the employer. This contribution is collected through the payslip, following a model similar to that of company health insurance plans.

What happens if an employee leaves the company?

Three options are available if an employee leaves the company:

- Bike buyout: The employee can purchase the bike at a discounted rate.

- Contract transfer: The rental contract can be transferred to another employee within the company.

- Contract termination: The employee can terminate the rental contract. Termination fees may apply, but with the ZenFlex option, these fees are covered.

Do you offer a buyout option for the bikes?

Yes, Avo’Mobility is committed to offering an attractive buyout option at the end of the contract. Typically, this offer is set at 20% of the original retail price including VAT of the bike and its accessories (helmet, lock).

How can employee interest be measured?

We provide free survey tools to help assess your employees’ interest. You can easily share them with your employer to demonstrate the enthusiasm for a bike offering.

What grants and subsidies are available for businesses?

Businesses can benefit from several grants and tax incentives for acquiring bikes. In particular:

- Tax deduction: Up to 25% of expenses related to company bikes are deductible from corporate tax.

- Eligibility criteria:

- Covering at least 70% of the employee’s monthly subscription.

- Rental contract lasting more than 36 months.

Is bike rental considered a benefit in kind?

No, according to URSSAF, the rental of a personal bike is not considered a benefit in kind. This means:

- No additional social charges for the company.

- No contributions or taxes for the employee.